iLoan Calc (Loan calculator)

iLoan Calc (Loan calculator) sehr gutes Programm aus Natsu

Release-Datum 15 years ago 8.0 version.You can calculate not only your mortgage but also your car loan or other loans.

[Simple user interface]

Its very simple to use. You can see your loan to be setting up 4 basic entries: Total loan amount, Interest rate, Term and Payment method.

[Detail settings]

Detail can be added as needed. For example, bonus payment, accelerated repayment and so on.

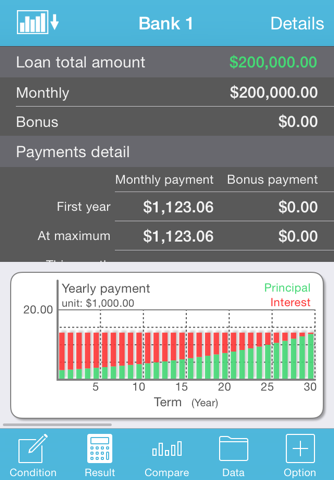

[Loan simulation]

iLoan Calc calculate your loan exactly. If both the repayment start date and the borrowing date are set, daily interest is calculated.

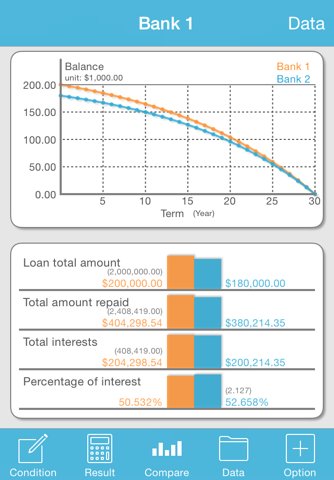

[Comparison]

You can compare between loans with different settings. Moreover, the comparison with/without accelerated repayment is also available. This allows you to check the effect of accelerated repayment easily.

[Main features]

- Calculation of each amount:

- monthly payment

- bonus payment

- yearly payment

- total payment

- total interest

- percentage of interest allocation, etc.

- Show the amortization schedule, export as a CSV file.

- Show graphs (historical graph, comparison graph)

- Comparison:

- compare with/without accelerated repayment

- comparison between data

- Save data

- Calculate the loan amount using a subsidiary calculation function:

- from desired repayment amount

- annual income

[Settable entries]

- Loan amount

- Interest rate and type (Fixed, Fixed multi-step, Variable)

- Loan term

- Payment method (Principal equal, Interest equal)

- Bonus payment

- Accelerated repayment (Reduce the total term, Reduce the monthly payment)

- Various cost (Fees, Taxes, Insurance etc)

- Starting date

- Starting age

- Borrowing date

[Notes about calculation]

- 5 year rule, 125% rule

Amount of monthly payment is revised once every 5 year when you setup variable interest rate (5 year rule). The maximum amount of payment after the adjustment is 1.25 times more than the original amount (125% rule).

- Accelerated repayment with reducing total term for the bonus payment

If you accelerate repayment by reducing the total term, the reduced term is every 6 months (if you select twice a year bonus payment) or 12 months (if you select once a year bonus payment).

* iLoan Calc is an application that allows you to calculate various amount of a loan.

Please note that the results on this application gives a guideline and does not necessarily correspond to the results of financial institutions.

Andere Anwendungen von Natsu

ローン計算 iLoan CalcclockBIN pro (Binary Clock&Timer)

iLoan Calc Simple

omoide Pro - easy movie maker

omoide - easy movie maker